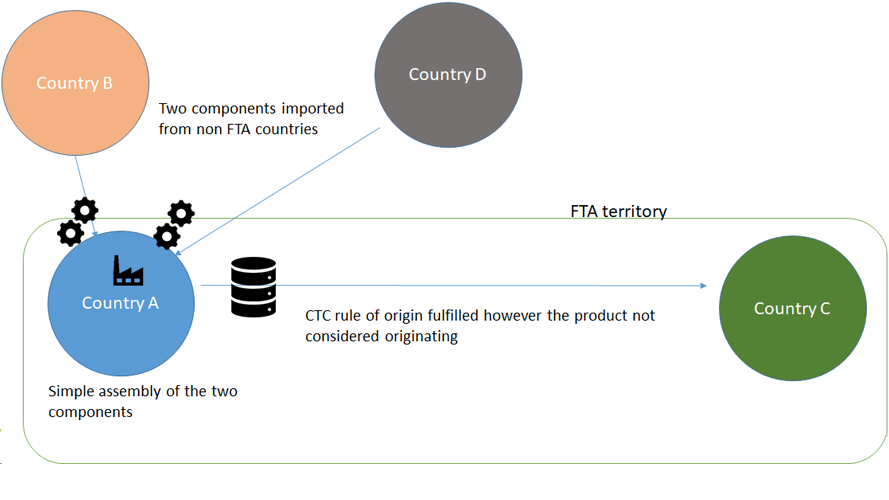

For example HS Code 620520 would therefore comprise of the following. Egg in the shells.

Why You Shouldn T Include Hs Numbers On A Commercial Invoice

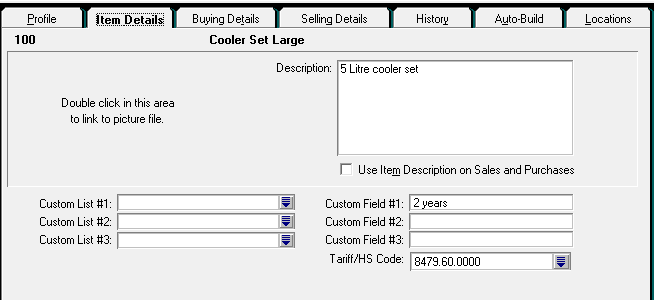

Under the Harmonized Commodity Description and Coding System.

. Ad With Avalara item classification youll get more accurate tariff codes faster. Last published date. The importations of goods specified below are prohibited except under an import licence or permit from relevant authorities.

Simple steps to get the correct tariff code and how to avoid disputes 3-4 July. Tatacara Permohonan Lesen Vape. Printed international customs forms carnets and parts thereof in English or French whether or not in additional languages Goods eligible for temporary.

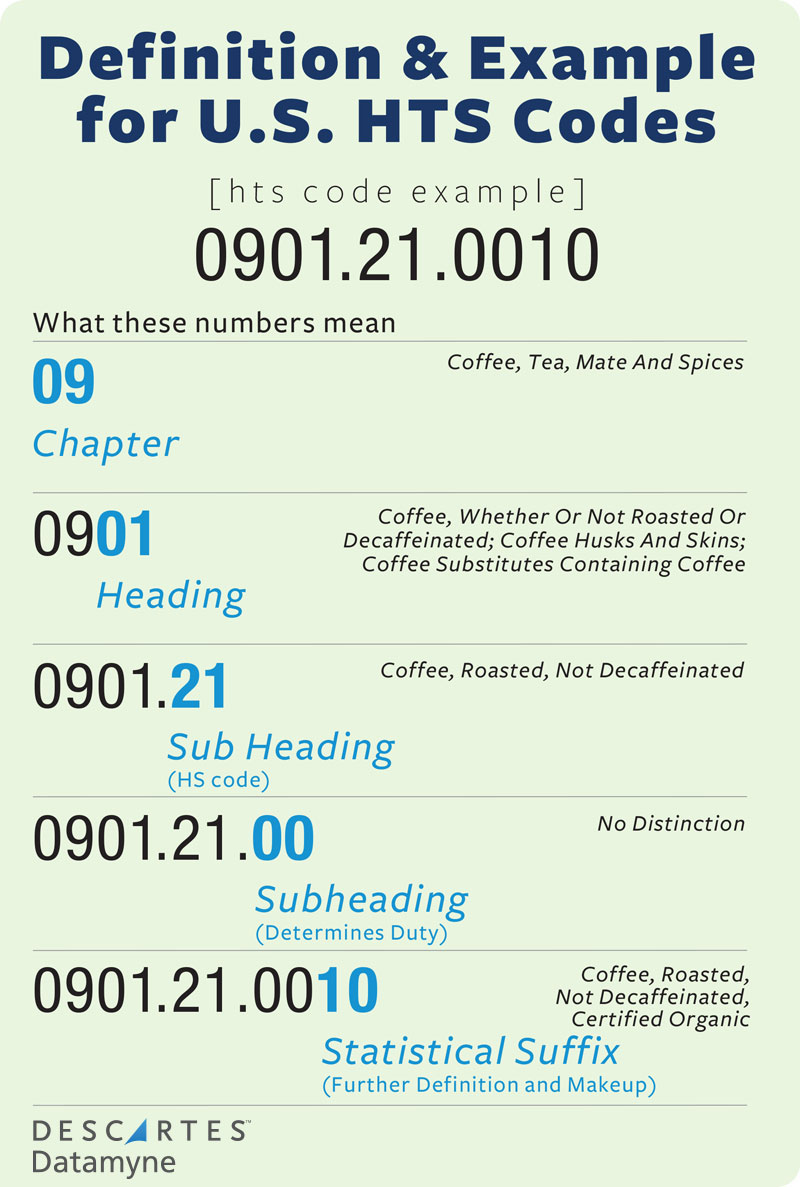

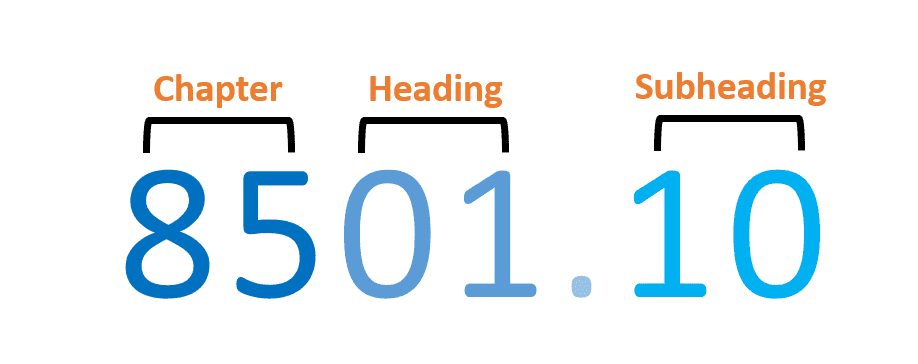

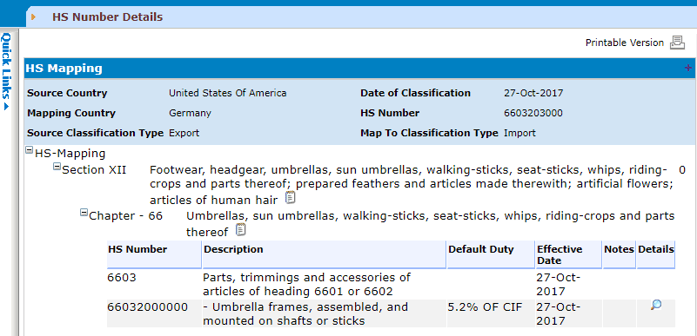

TARIFF SCHEDULE OF MALAYSIA Tariff schedules and appendices are subject to legal review transposition and verification by the Parties. Trying to get tariff data. Harmonized Commodity Description Coding System commonly known as HS Codes and ASEAN Harmonized Tariff Nomenclature AHTN were created for international use by the.

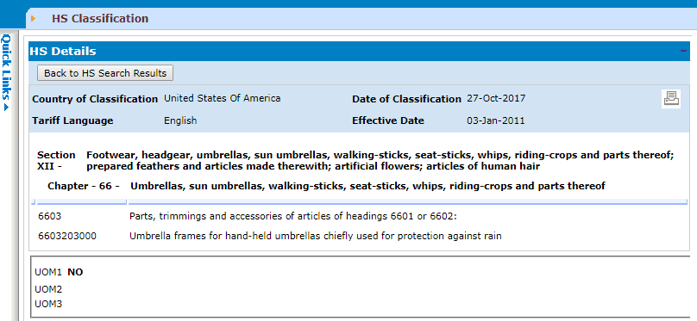

Items are categorized according to Harmonized Commodity Description and Coding. Failure to classify products correctly will not. This website is developed to enable the public to access information related to the Royal Malaysian Customs Department includes corporate information organization and.

For further enquiries please contact Customs Call Center. Malaysias tariffs are typically imposed on a value-add basis with a simple average applied tariff of 61 percent for industrial goods. Statistics on Malaysian Companies registered with MATRADE Of Agricultural Produce.

Our automated process saves you the time and hassle of looking up HS codes. 05 Heading Mens or Boys. Malaysia custom hs code.

Printed international customs forms carnets and parts thereof in English or French whether or not in additional languages Goods eligible for. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia. Customs tariff For goods such as alcohol wine poultry and pork Malaysia charge high effective tariff rates usually up to 60 ad valorem.

Our automated process saves you the time and hassle of looking up HS codes. Tariff nomenclature is an internationally standardized system of names and numbers to classify traded products. The Ministry of Finance announced on July 16 2018 the SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5.

MALAYSIAS TARIFF SCHEDULE UNDER THE MALAYSIA-INDIA COMPREHENSIVE ECONOMIC COOPERATION AGREEMENT MICECA HS CODE Chapter 1 - Live animals. LIST OF MEASURES IMPOSED BY MALAYSIA. Customs Classification of Goods entails classifying products into correct tariff codes to determine the amount of duty payable.

Customs search engine to get the correct tariff code under the Customs Duties Order 2017 and Customs Duties Goods of ASEAN Countries origin ASEAN Harmonized Tariff Nomenclature. The only authentic tariff commitments are those. Classification and duty allocation for items are done at Valuation and Tariff Section.

Tariff duties where local production is significant. 62 Chapter - Articles of apparel and clothing accessories not knitted or crocheted. Any meat bones hide skin hoofs horns.

Ad With Avalara item classification youll get more accurate tariff codes faster. Customs Duties Exemption Order 2017. Malaysia continued to maintain tariff-rate quotas TRQs for 17 tariff lines HS2012 including live swine and poultry poultry.

1 300 88 8500 General Enquiries Operation Hours Monday - Friday 830 am 700 pm email. It came into effect in 1988 and has since been developed. Statistics On Malaysian Companies Registered With MATRADE of Architectural Services.

Malaysias total trade soars 213 to RM23144 bil in April 2022 MITI - The Edge Markets MY Malaysias total trade soars 213 to RM23144 bil in April 2022 MITI The Edge Markets MY. Pursuant to Public Law 117-110 effective April 9 2022 all products permitted admission into the customs territory of the United States from Russia and Belarus will be assessed the column 2.

Hs Code All About Classification Of Goods In Export Import

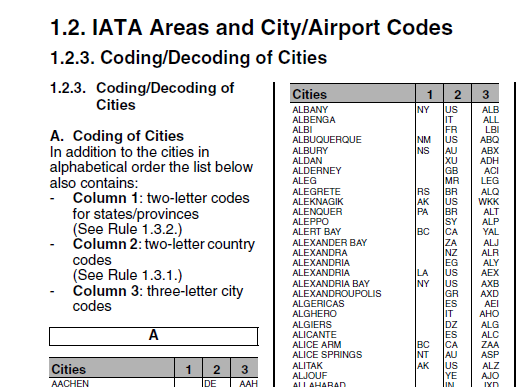

Iata Air Cargo Tariffs And Rules What You Need To Know

Hs Code All About Classification Of Goods In Export Import

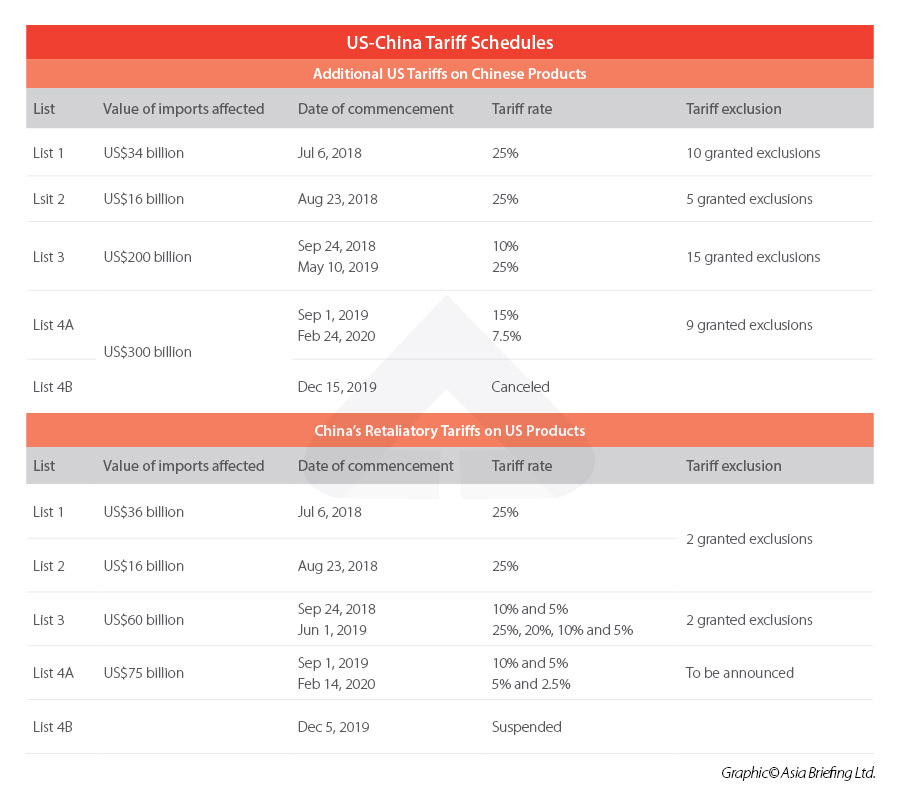

Us Tariff Exclusion Process For Chinese Imports What Is The Status

Us Tariff Exclusion Process For Chinese Imports What Is The Status

Hts Codes Complete Guide To International Imports 2022

What Is An Hs Or Hts Code In Import Export Business Alibaba Seller Blog

Main Goods In Extra Eu Exports Statistics Explained

The Harmonization Code System Hs Code 630533

Why You Shouldn T Include Hs Numbers On A Commercial Invoice

How Do I Find My Hts Code Usa Customs Clearance

How To Find Your Product S Commodity Code Tariff Codes Commodity Codes Uk Checker Shippo Shipping Uk China

Fiori App Library List Tutorial S 4hana Sap Blogs